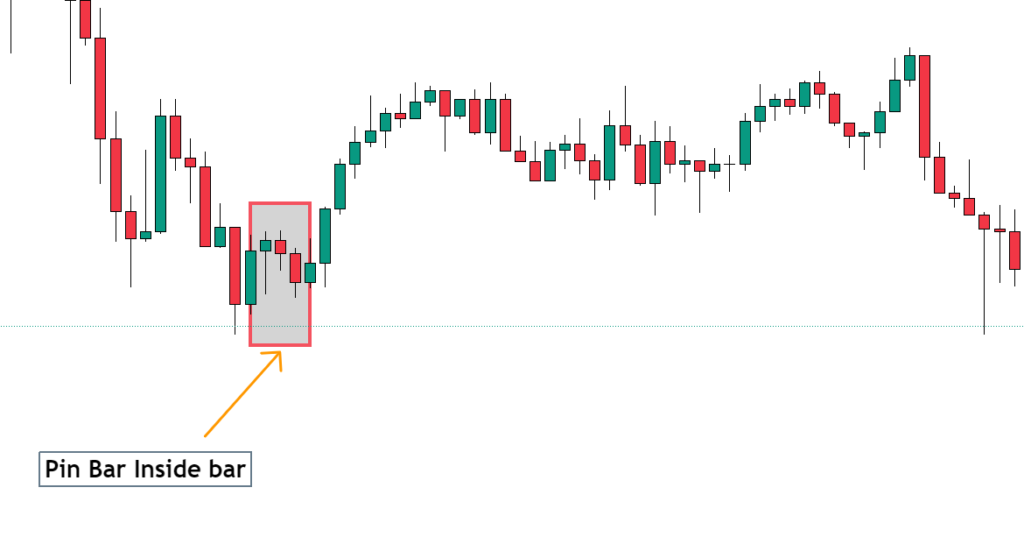

The combination of a Pin Bar followed by an Inside Bar is a potent price action pattern that offers valuable insights into potential reversals and continuations in the market.

Understanding The Pin Bar Inside Bar Combo Pattern

Table of Contents

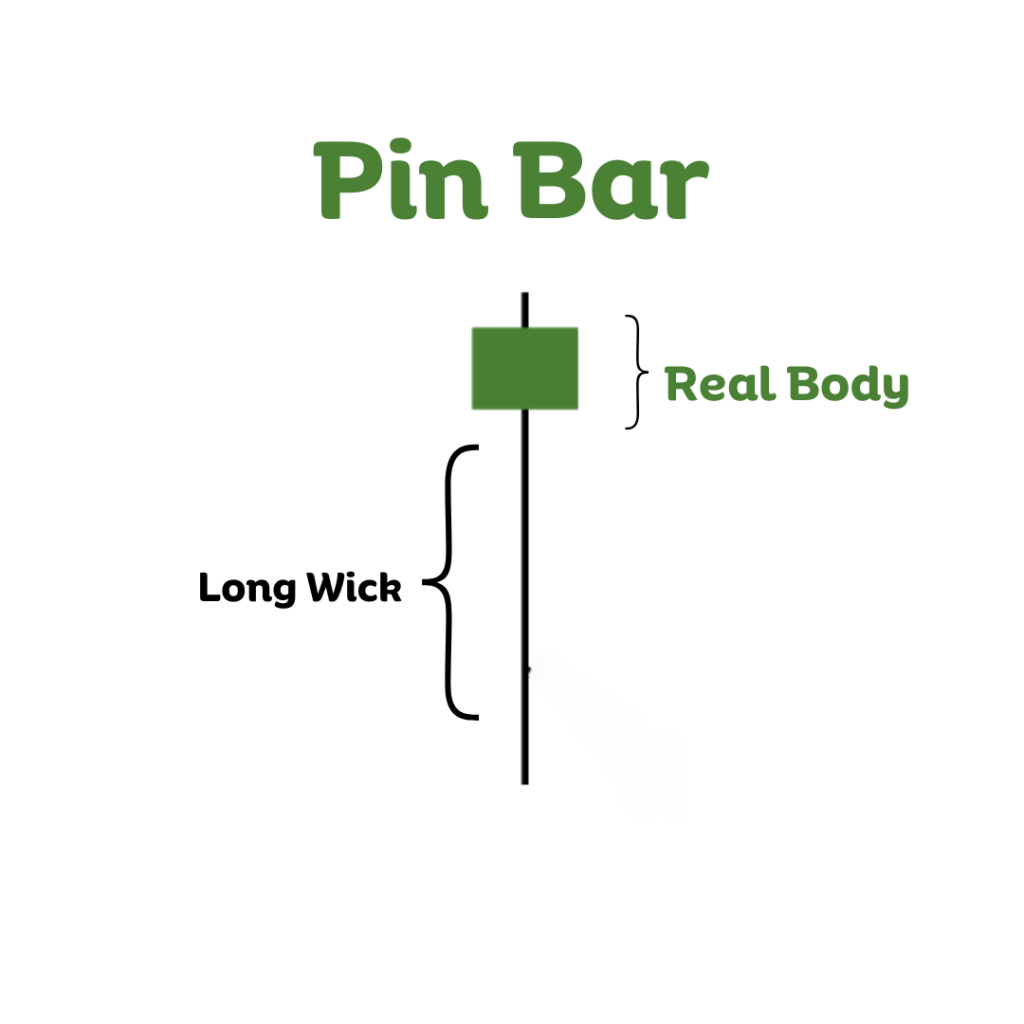

What is Pin Bar

- Characterized by a small body and a long wick (shadow) on one end, signifying a strong rejection of the current price level.

- Indicates indecision and a potential shift in momentum.

- Can be either Bullish (long lower wick) or Bearish (long upper wick).

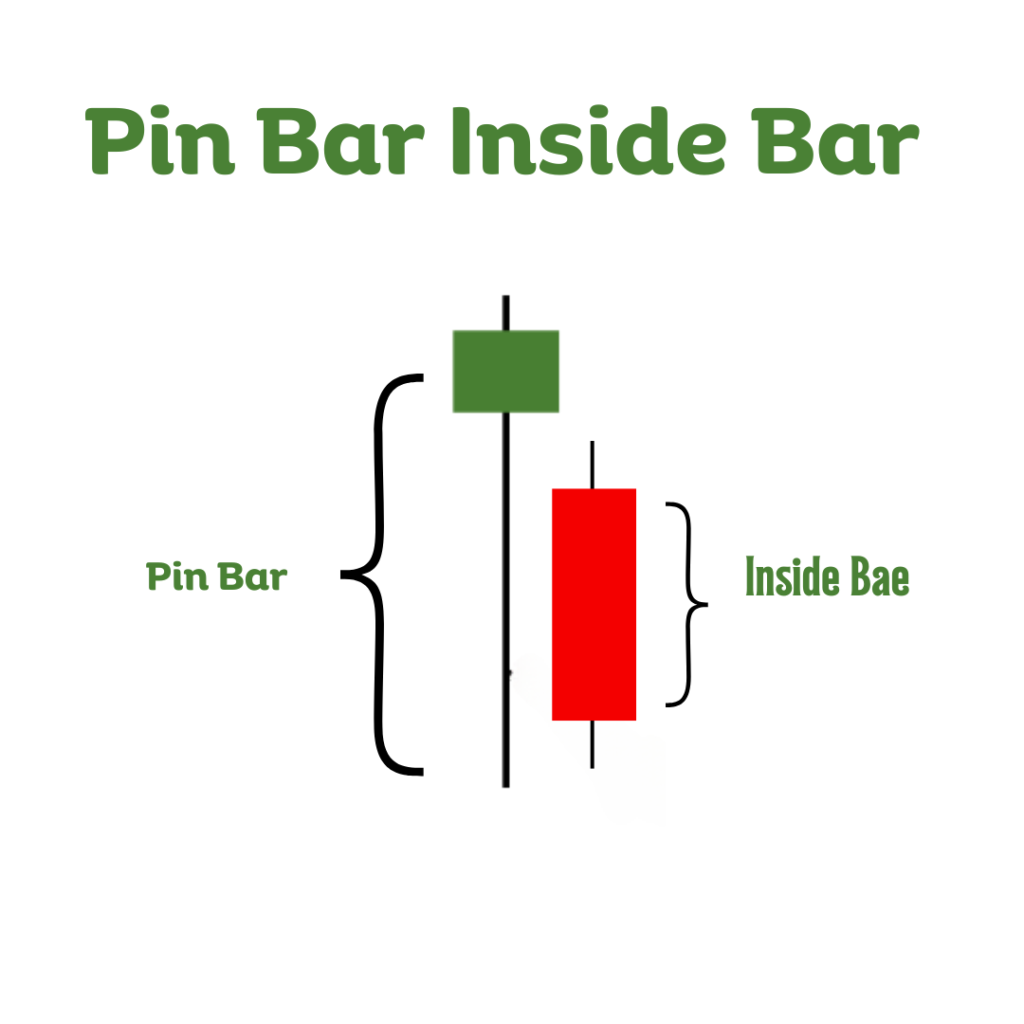

What is the Pin Bar Inside Bar Combo pattern

- Forms entirely within the range of the previous Pin Bar.

- Represents a period of consolidation and indecision after the initial rejection.

- Can be either Bullish (green body) or Bearish (red body).

Trading the Pin Bar Inside Bar Pattern:

The specific trading strategy depends on the direction of the Pin Bar and the Inside Bar:

1. Bullish Pin Bar + Bullish Inside Bar:

- Signal: Potential continuation of the uptrend after a temporary pullback.

- Entry: Long trade above the high of the Inside Bar.

- Stop-loss: Below the low of the Inside Bar.

- Take-profit: Based on technical analysis, risk-reward ratios, or trailing stops.

2. Bearish Pin Bar + Bearish Inside Bar:

- Signal: Potential continuation of the downtrend after a temporary rally.

- Entry: Short trade below the low of the Inside Bar.

- Stop-loss: Above the high of the Inside Bar.

- Take-profit: Based on technical analysis, risk-reward ratios, or trailing stops.

3. Pin Bar + Inside Bar Against the Trend:

- Signal: Potential reversal of the trend.

- Requires additional confirmation: Look for other technical indicators or chart patterns to support the reversal.

- Stop-loss: Tightly placed above/below the Pin Bar’s wick for quick exit if the reversal fails.

- Take-profit: Based on technical analysis, risk-reward ratios, or trailing stops.

Additional Tips:

- Higher timeframes: Focus on daily, weekly, or higher timeframes for more reliable signals.

- Volume analysis: High volume on the Pin Bar can strengthen the signal.

- Confirmation: Combine the Pin Bar Inside Bar with other technical indicators like moving averages or oscillators.

- Practice and risk management: Refine your strategies and practice in a demo account before risking real capital.

Remember:

- The Pin Bar Inside Bar pattern is a powerful tool, but it’s not foolproof.

- Always use additional confirmation and manage your risk effectively.

- Continuously learn and adapt your strategies based on market conditions and experience.

By understanding the Pin Bar Inside Bar pattern and implementing these tips, you can improve your ability to identify potential reversals and continuations, leading to more profitable trading opportunities

Post a Comment