|

| There are only three things price can do: 1. Breakout from a Range and Trend. 2. Breakout from a Range and Reverse. 3. Trading Range between Highs and Lows. |

1. Structure / Pattern

- Do we have any larger geometrical patterns?

- Head and Shoulders / Sell (Reverse Head and Shoulders / Buy)

- Descending Triangle (Sell) Ascending Triangle (Buy)

- Double Bottoms (Buy), Double Tops (Sell)

- Rectangles (Continuation / Reversal)

- Helps us identify geometric patterns for potential measured move profit targets for asymmetrical risk / reward.

2. High of the Day (HOD) / Low of the Day (LOD)

Where is the high, where is the low? There is a high and a low that the market is trading inside of. The market is either in a consolidation or a break out. The current HOD and LOD may be inside of a larger rectangle.

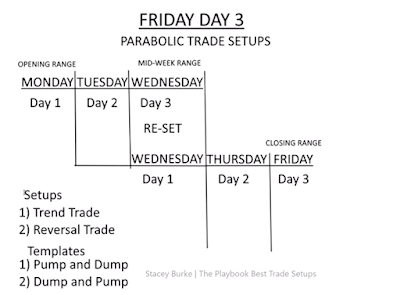

3. Timings

My focus is on the 3 hour window. 1 hour before the equity markets open, the hour of the equity markets open, and the hour after the equity markets open. Hence 12 - 15 minute candles.

- ASIA 8-11 pm NY EST

- EUR / LONDON 2-5 am NY EST

- NEW YORK 8-11 am NY EST

4. Round Numbers

Typically these trades will come off of round numbers, specifically 00’s and 50’s. The quarter levels, 25 and 75 will often be a “stop hunt” extension of a 50 or 00 trading box.

5. Price Behaviour for Trade Setups

I look for engulfments and pin hammers. These can be “with trend” trades, or reversals, for stop hunts or in a trading range.I look to ENTER the majority of my trades “AT OR NEAR” number, i.e. 25, 50, 75, 00. Sometimes I may limit order these trades, others I may just get filled at market.

• “M” PATTERNS - TYPE 1,2,3

• “W” PATTERNS - TYPE 1,2,3

• “W” PATTERNS - TYPE 1,2,3

6. Risk Management / Profit Targets

My average STOP LOSS is 1 ATR. For most of the pairs it will be 20 pips. The GBPAUD, GBPNZD may be 25. Depending on the level of volatility on the day, on the pair, it may be a bit more or less give or take. Typically though, I am looking for a 1 bar stop. Position sizing can depend on the type of setup, and the size of stop loss.

The minimum PROFIT TARGET is usually 50 pips. Sometimes a market may hit a previous day’s high or low, or the current day’s high or low, OR SIGNIFICANT ROUND NUMBERS, 00, 50, and the market may stop there. I may only be up 40 pips. When those levels are prominent, it may be necessary to adjust that target on the day, based on HOW PRICE BEHAVES when it gets to those levels. Other trades (Measured Moves) may be in the area of 50-75 or a 100 or more pips. Again, depending on the setup and how that pair is trading on the day.

The minimum PROFIT TARGET is usually 50 pips. Sometimes a market may hit a previous day’s high or low, or the current day’s high or low, OR SIGNIFICANT ROUND NUMBERS, 00, 50, and the market may stop there. I may only be up 40 pips. When those levels are prominent, it may be necessary to adjust that target on the day, based on HOW PRICE BEHAVES when it gets to those levels. Other trades (Measured Moves) may be in the area of 50-75 or a 100 or more pips. Again, depending on the setup and how that pair is trading on the day.

7. Trade Management / Self Management

Once I am in the trade, I will fight every urge that I have to interfere with it. I review the trade setup and thesis that I have for the trade. I monitor the behaviour initially based on my thesis. I will typically leave the screen, or watch, and monitor myself, self talk, do meditation, and possibly review the other pairs to identify any other setups.

I will normally NOT ADJUST my stop loss to BREAK EVEN UNTIL, the market has broken a high or low boundary, ( I wait for the 15 min candle to close) OR it has CLOSED 30 pips or more, breaking into the next quarterly range. At 40 pips, depending on if the market has moved (fast or creeping) I will potentially look to LOCK IN 40 pips if the market has “two-sided” trading occurring near my profit target. So, to clarify, if it has spent 30 minutes near my target without hitting it, I will be watching closely to “LOCK IN” profits, in case the market is preparing to reverse. When you are up 40 pips, YOU NEED TO GET PAID.

Quoted from:

Post a Comment