Have you ever gazed at the night sky, spotted a shooting star, and made a wish? In the world of trading, spotting a Shooting Star candlestick pattern might not grant wishes, but it can certainly signal something significant.

This intriguing pattern often appears at the top of an uptrend, potentially heralding a bearish reversal.

But what makes the Shooting Star so noteworthy among traders, and how can you effectively integrate it into your trading strategy? Let’s embark on a journey to uncover the secrets of the Shooting Star pattern.

What is the Shooting Star Candlestick Pattern?

Table of Contents

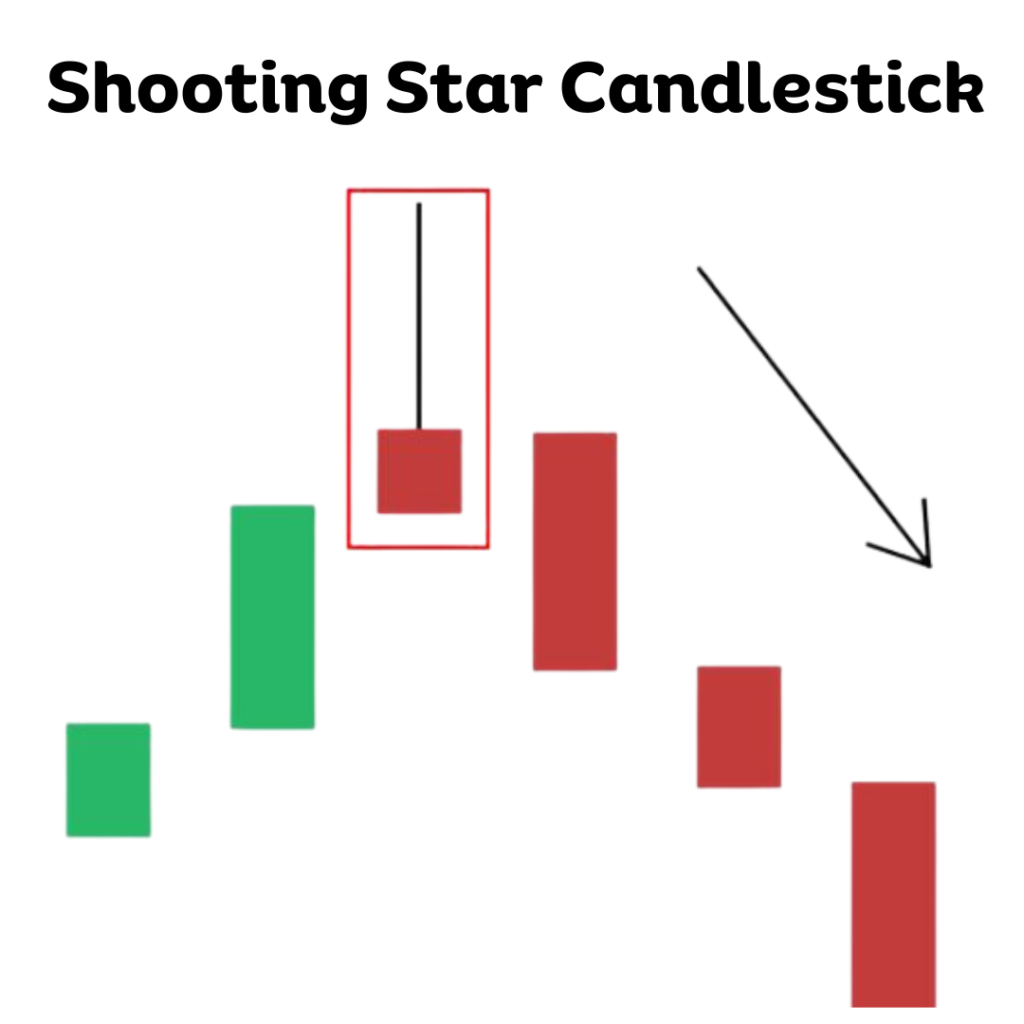

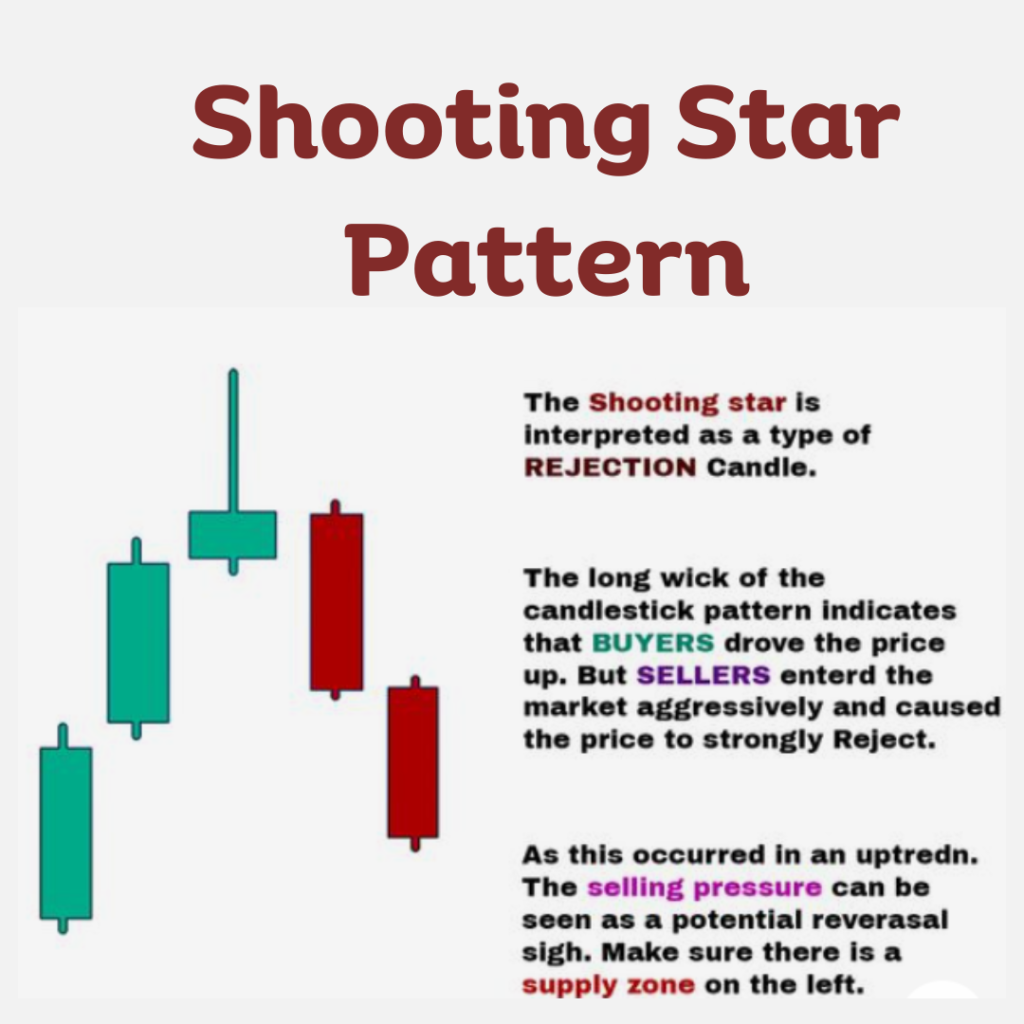

The Shooting Star is a bearish reversal candlestick pattern, typically occurring after an uptrend. It resembles a falling star with a long upper shadow and a small lower body.

This pattern indicates that the buyers initially pushed the price higher, but by the end of the trading period, sellers managed to pull it back down, close to the opening price. For traders, recognizing a Shooting Star can be crucial in anticipating a potential downturn in the market.

Anatomy of the Shooting Star

A proper understanding of the Shooting Star’s anatomy is essential for accurate identification:

- Small Lower Body: The lower body (the area between the open and close prices) is small, indicating a narrow range between the opening and closing prices.

- Long Upper Shadow: The hallmark of the Shooting Star is its long upper shadow, at least twice the length of the body, showing a significant pushback by sellers.

- Color of the Body: While the color of the body (red for a downward move or green for an upward move) is not crucial, a red body can indicate a stronger bearish signal.

- Position in Trend: It’s typically found at the end of an uptrend, signaling that the bullish momentum might be waning.

Trading the Shooting Star Pattern: A Complete Strategy

Identification

The first step in trading the Shooting Star pattern is to spot it at the peak of an uptrend. Its effectiveness is heightened when it appears after a consistent bullish momentum.

Confirmation

Before jumping into a trade, wait for confirmation in the form of a bearish candlestick following the Shooting Star. This subsequent candle should ideally close below the Shooting Star’s low.

Entry Point

Enter a trade after the confirmation candle closes, ensuring the bearish reversal is more likely to occur.

Stop Loss Placement

Place your stop loss just above the high of the Shooting Star to minimize potential losses if the trend does not reverse as anticipated.

Take Profit

Setting a take profit depends on the market structure and your trading strategy. Common targets are significant support levels or a predetermined risk-reward ratio.

Conclusion

The Shooting Star candlestick pattern is a valuable tool in the trader’s toolkit for identifying potential bearish reversals. However, like all technical indicators, it should be used judiciously and in conjunction with other analysis methods. A disciplined approach to trading, incorporating sound risk management and consistent strategy, is key to capitalizing on these patterns. Remember, each pattern is just one piece of the complex puzzle of market analysis.

Have you had any experiences trading the Shooting Star pattern? Share your insights or questions in the comments below, and let’s grow together in our trading knowledge!

Post a Comment